Are you interested in forex trading but lack the time, experience, or confidence to trade on your own? A PAMM account (Percentage Allocation Management Module) might be the perfect solution! With PAMM accounts, you can invest in forex markets by allowing professional traders to manage your funds. This means you can earn potential profits without making trading decisions yourself.

In this guide, we’ll break down how PAMM accounts work, their benefits and risks, and how you can start investing in one.

What is a PAMM Account?

A PAMM account is a pooled investment system in which multiple investors entrust their money to a skilled forex trader (money manager). The money manager then trades on behalf of these investors. Profits and losses are shared among the investors based on their percentage contribution to the pooled fund.

Think of it like a mutual fund for forex trading—where instead of choosing stocks, your chosen trader handles all the trading for you.

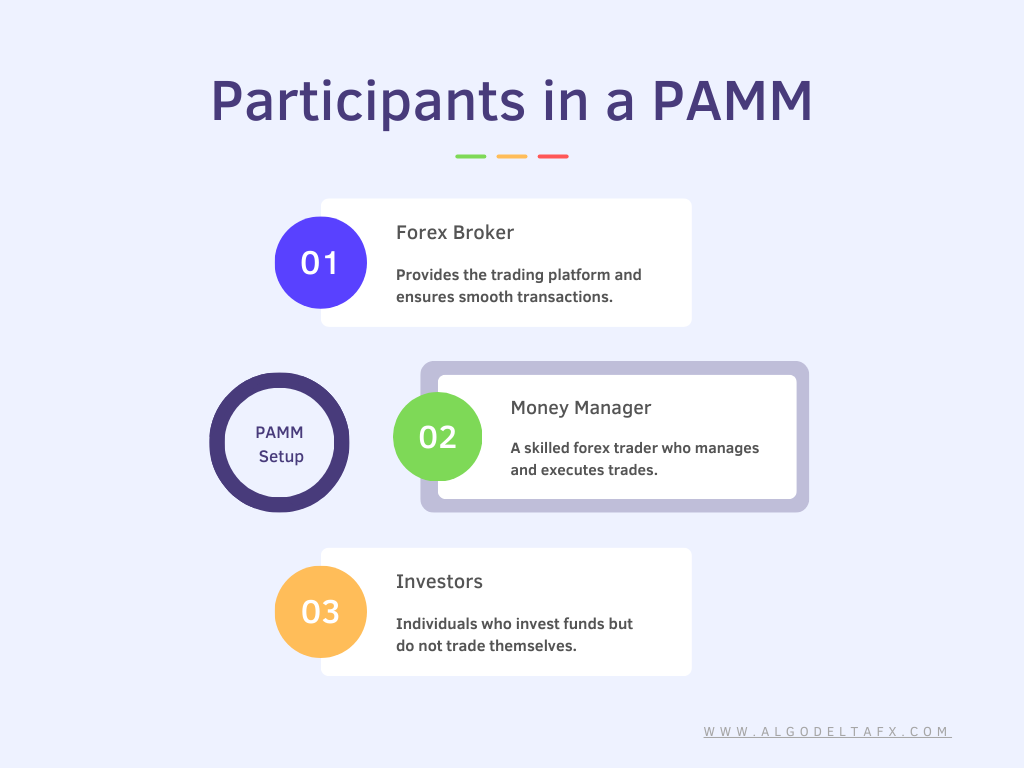

Who Are the Participants in a PAMM Setup?

A PAMM account usually involves three key participants:

- Forex Broker: Provides the trading platform and ensures smooth transactions.

- Money Manager (Trader): A skilled forex trader who manages and executes trades.

- Investors: Individuals who invest funds but do not trade themselves.

Now, let’s break down how this works in real-world scenarios with examples.

How Does a PAMM Account Work?

Let’s imagine a scenario to understand this better.

Meet the Investors & Trader:

- Isaac , Iker, and Iliana want to invest in forex but don’t have the skills or time.

- They find Tom, an experienced forex trader with a solid track record.

- The forex broker allows them to join Tom’s PAMM account.

Investment Breakdown:

- Isaac invests $5,000

- Iker invests $3,000

- Iliana invests $2,000

- Tom (Trader) contributes $5,000 of his own money

This means the total pooled fund is $15,000. Here’s how their percentage ownership looks:

- Isaac = 33.3%

- Iker = 20%

- Iliana = 13.3%

- Tom (Trader) = 33.3%

First Trading Cycle (Winning Month) 🚀

Tom trades the $15,000 pool and generates a 20% profit. The total account balance rises to $18,000 (a profit of $3,000).

Tom takes a 10% performance fee on the profits ($300), and the remaining $2,700 profit is shared among the investors.

- Isaac earns $900

- Iker earns $540

- Iliana earns $360

- Tom earns $900 (excluding his 10% cut from the profits)

Second Trading Cycle (Adding New Investors)

Seeing the success, two new investors, Ivana and Izan, decide to join:

- Ivana invests $2,500

- Izan invests $1,500

The new total fund is $22,000, and each investor’s share gets adjusted accordingly. Tom continues trading and generates another 15% profit, making the total account balance $25,300. Profits are distributed, and Tom takes his 10% cut on the $3,300 profit.

Third Trading Cycle (Losing Month) ❌

No trader wins every time. In the next month, Tom faces a loss of 10%. The total balance drops from $25,300 to $22,770. Each investor sees a proportional loss based on their share in the fund.

At this point, investors can choose to continue with Tom, switch to another trader, or withdraw their money.

Pros and Cons of PAMM Accounts

✅ Benefits:

✅ Passive Income: Investors don’t have to trade themselves.

✅ Access to Expert Traders: Professionals manage your funds.

✅ Diversification: Some brokers allow investors to split funds among multiple traders.

✅ No Direct Management: Traders cannot withdraw investor funds—only trade them.

❌ Risks:

❌ Risk of Loss: If the money manager performs poorly, investors lose money.

❌ High Dependence: Success relies entirely on the trader’s skills.

❌ Fees & Commissions: Most PAMM accounts charge performance fees.

How to Choose a Reliable PAMM Manager?

Before investing, research trader performance and strategies. Here’s what to look for:

- ✨ Trading History: Choose managers with a consistent track record of profits.

- ✨ Risk Management: Avoid traders with frequent high-risk trades.

- ✨ Investment Terms: Understand the manager’s fees and withdrawal policies.

- ✨ User Reviews & Ratings: Read feedback from other investors.

- ✨ Transparency: Look for traders who openly share performance data.

Is a PAMM Account Right for You?

PAMM accounts are great for those who want to earn from forex trading without actively trading. However, they come with risks, so always diversify and invest wisely.

If you’re looking for an automated, hands-free forex trading experience, PAMM accounts could be a great choice! Just make sure to pick a trusted broker and experienced money manager to minimize risks.

💎 Ready to invest in forex the smart way? Explore different PAMM accounts, check manager performance, and start your passive income journey today!

Final Thoughts

PAMM accounts offer an exciting way to invest in forex without the need for technical skills. Whether you’re a beginner looking for passive profits or an experienced trader aiming to diversify, PAMM accounts provide a structured approach to forex investment.

However, always do your research, understand the risks, and choose your money manager wisely!

🌟 Have questions about PAMM accounts? Drop them in the comments!

Looking for the best forex copy trading & multi-account management software? Check this out! 👉 Best Forex Copy Trading Software

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing.

source : investopedia