Tesla’s earnings report is just around the corner, and investors are anxiously waiting to see what the future holds for the electric vehicle (EV) giant. While CEO Elon Musk had previously aimed for a 30% growth in sales, Wall Street analysts have a much more cautious outlook, predicting only 16% growth. This comes after Tesla failed to meet its own ambitious sales target last year, selling under 1.8 million EVs worldwide.

Will Tesla be able to bounce back, or is the company facing a rough road ahead? Let’s dive into the key factors influencing Tesla’s future.

Tesla’s Strategy: New Models and Innovations 🚗💡

To regain momentum, Tesla recently launched an updated version of its Model Y, which, despite being released in 2018, became the best-selling car in 2023. However, the real game-changer could be the rumored “Model Q” — an affordable EV aimed at mass-market buyers. Industry experts believe this budget-friendly car could boost Tesla’s sales by 20% to 30%, though it might put pressure on profit margins.

At the same time, Tesla is working on other innovations that could shape the future of the automotive industry, including:

✅ Autonomous ride-sharing services in California and Texas.

✅ Humanoid robotics that could revolutionize automation.

✅ Electric semi trucks for commercial transport.

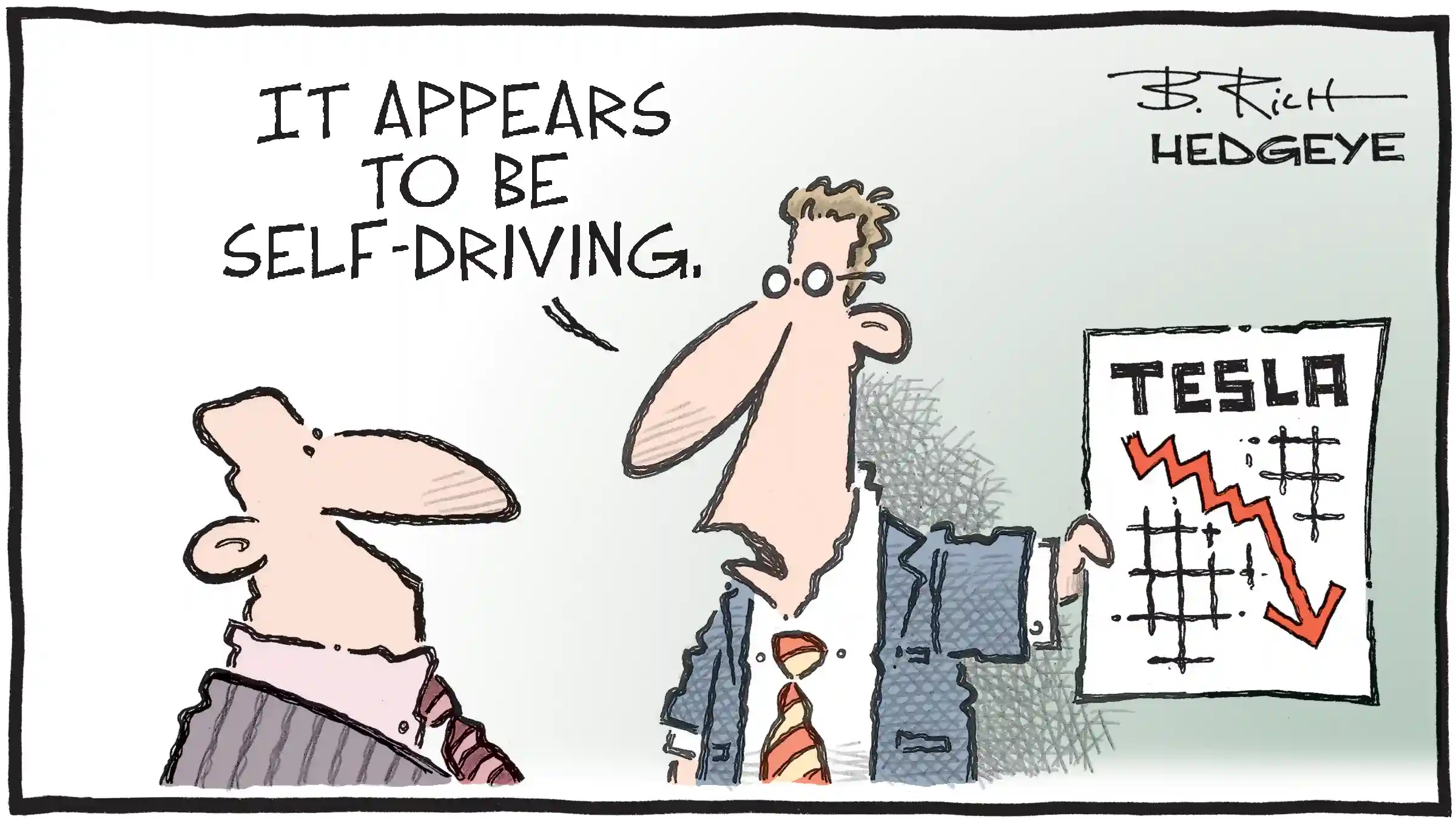

Challenges Facing Tesla ⛔📉

Despite these exciting developments, Tesla faces multiple challenges that could impact its performance:

1. Elon Musk’s Divided Focus 🧑🚀📡 Musk is not just running Tesla; he is also the CEO of SpaceX, Neuralink, The Boring Company, and social media platform X (formerly Twitter). Investors worry that his split attention could slow down Tesla’s growth and strategic decision-making.

2. Increasing Competition ⚔️🔋 Tesla is no longer the only dominant player in the EV market. Companies like BYD, Rivian, Lucid Motors, and legacy automakers like Ford and Volkswagen are aggressively expanding their EV lineups, making it harder for Tesla to maintain its market lead.

3. Potential Regulatory Challenges ⚖️📜 Government policies play a crucial role in Tesla’s success. If regulations surrounding EV incentives, emissions standards, or autonomous vehicles change, Tesla may need to adapt quickly to remain competitive.

4. Slowing EV Demand 🚦📊 While the EV market is growing, sales have started to slow down in some regions due to high costs and limited charging infrastructure. Tesla’s ability to address these issues will be key to sustaining long-term growth.

How Tesla’s Earnings Report Impacts the Market 📈🌍

Tesla is not just another car company — its earnings and performance affect the entire EV industry and stock market. Here’s why:

🔋 Impact on the EV Industry: If Tesla struggles to grow, it could signal a slowdown in EV adoption, making investors hesitant about other EV stocks.

🌱 Environmental Impact: A weaker Tesla could mean slower progress in reducing carbon emissions, affecting global climate goals.

🏭 Job Market and Economy: Tesla’s success drives job creation in manufacturing, battery production, and autonomous technology. If the company faces challenges, thousands of jobs could be at stake.

Tesla’s Strengths and Weaknesses: A Quick Look ⚖️

✅ Pros:

- Strong brand loyalty and global presence.

- Continuous innovation in AI, self-driving technology, and EV battery advancements.

- Expansion into new markets and product categories.

- Potential “Model Q” could attract budget-conscious buyers.

⛔ Cons:

- Intense competition from legacy automakers and new EV startups.

- Dependence on government regulations and EV incentives.

- Uncertainty surrounding Musk’s commitment and leadership focus.

- Price reductions to boost demand could hurt profit margins.

What Investors Should Watch For 👀

With Tesla’s stock price doubling over the past year, the upcoming earnings report is critical for determining its future trajectory. Investors should pay close attention to:

📌 Growth Projections: Will Tesla adjust its 30% growth target?

📌 Profit Margins: Will price cuts impact Tesla’s overall earnings?

📌 Autonomous Driving Updates: Any progress on self-driving technology and ride-sharing?

📌 New Model Announcements: Will Tesla confirm the Model Q or other major product releases?

📌 Musk’s Leadership Plans: Will he remain fully committed to Tesla?

Final Thoughts: Can Tesla Maintain Its Market Dominance? 🤔

Tesla has always been a company that thrives on innovation and disruption, but it now faces some of its biggest challenges yet. While new products like the Model Q and autonomous services offer exciting opportunities, competition, regulations, and leadership concerns create uncertainty.

For investors and EV enthusiasts alike, the next few months will be crucial in determining whether Tesla remains the undisputed EV leader or if it will struggle to keep up in an increasingly crowded market.

As Tesla faces challenges, another revolution is reshaping the tech world. Guess who’s shaking up US tech giants? Discover DeepSeek AI here.

Stay tuned, because Tesla’s next moves could shape the future of electric vehicles and sustainable technology for years to come! ⚡🌎🚗

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.

source : independent.co , boldbusiness