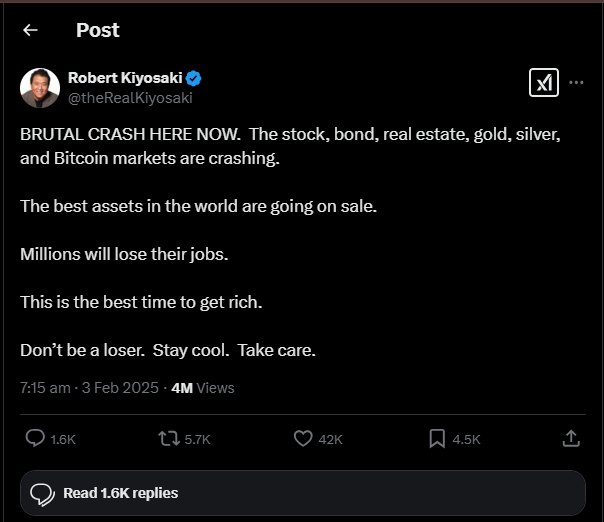

The cryptocurrency market is going through a rough period, with Bitcoin and other major assets experiencing significant losses. Robert Kiyosaki, the famous author of Rich Dad Poor Dad, has weighed in on the situation, calling it a “brutal crash.” According to him, Bitcoin, stocks, bonds, real estate, gold, and silver are all facing steep declines. However, Kiyosaki remains optimistic, stating that this downturn presents a unique opportunity to accumulate valuable assets at lower prices.

Kiyosaki’s Prediction and Market Reaction

For years, Kiyosaki has warned that a major financial crash was on the horizon. Now, as markets take a hit, his predictions appear to be coming true. He believes that this crash will lead to massive job losses and economic hardship, but he also sees it as the best time for investors to build wealth by buying valuable assets at discounted prices.

Bitcoin’s Price Drop and Investor Sentiment

Bitcoin recently fell below $100,000, dropping as low as $91,231 before recovering slightly to around $103,000. This decline has led to panic among traders, resulting in over $10 billion in liquidations within 24 hours. The fear in the market is evident, with the Bitcoin Fear and Greed Index sitting at 44%, indicating caution among investors.

Despite the downturn, Kiyosaki remains bullish on Bitcoin’s long-term potential. He previously predicted that Bitcoin could reach $250,000 in 2025 and has consistently advised investors to accumulate more of the digital asset during dips.

The Impact of New Trade Tariffs

One of the major triggers of this market crash is the new set of trade tariffs introduced by the U.S. government. President Donald Trump announced tariffs of 25% on imports from Mexico and Canada and 10% on imports from China. These tariffs have sparked fears of a trade war, leading to instability in global financial markets.

As a result, stocks, commodities, and cryptocurrencies have all seen sharp declines. The Nasdaq 100 dropped by 1.61%, the S&P 500 fell by 1.36%, and the Dow Jones Industrial Average lost 1.22%. European markets also faced setbacks, with the STOXX 600 index dropping by 1.30%.

Debt and Economic Challenges

Kiyosaki believes that debt is the real issue behind these market crashes. According to him, economic problems will worsen due to the increasing burden of national and global debt. However, he argues that crashes are a normal part of market cycles and should be viewed as opportunities rather than disasters.

He pointed out that during the 2009 financial crisis, commercial real estate prices crashed, and he was able to purchase assets at a bargain, which later led to massive profits. He sees the current market downturn in a similar light, urging investors to stay calm and use this opportunity to buy valuable assets at lower prices.

What This Means for Crypto Investors

For those involved in cryptocurrency trading and investing, this crash might seem alarming, but history shows that Bitcoin has always recovered after major corrections. Market experts suggest that Bitcoin could bounce back, especially since February has historically been a strong month for the digital asset. Over the past 14 years, Bitcoin has posted positive returns in February 12 times, with an average gain of 15.66%.

While the current situation looks bleak, long-term investors may see this as a golden opportunity to accumulate more Bitcoin before the next upward trend begins.

Key Takeaways 💡

- Bitcoin and traditional markets are facing a “brutal crash.”

- Robert Kiyosaki sees this as a buying opportunity for Bitcoin, gold, and silver.

- The market crash was triggered by new U.S. trade tariffs on Canada, Mexico, and China.

- Over $10 billion in liquidations occurred in the crypto market within 24 hours.

- Bitcoin dropped below $100,000 but has since rebounded slightly.

- Kiyosaki believes debt is the real problem and that financial crashes present opportunities to accumulate wealth.

Final Thoughts

Market crashes can be stressful, but they also provide opportunities for investors who stay calm and make smart decisions. As Robert Kiyosaki suggests, now might be the best time to acquire assets like Bitcoin at discounted prices. While short-term volatility is inevitable, those who take advantage of the dip could see significant gains in the long run.

For traders and investors, the key is to stay informed, conduct thorough research, and make decisions based on long-term trends rather than short-term panic. Whether this crash turns into a deeper crisis or a temporary pullback, one thing is certain—markets always recover, and opportunities always exist for those willing to seize them.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing.

source : coinspeaker , u.today , finance.yahoo , cartoonstock