The Nonfarm Payrolls (NFP) report is one of the most watched economic indicators, offering a snapshot of the U.S. job market’s health. It reveals the number of new jobs created each month, excluding farm workers, government employees, and jobs in private households and nonprofits. The headline number, presented in thousands, provides a clear picture of job creation or loss, helping traders and analysts assess the health of the economy.

This report also includes key data like:

- Unemployment Rate: The percentage of people without jobs.

- Labor Force Participation Rate: The share of people working or actively looking for jobs.

- Average Hourly Earnings: A measure of how wages change month over month.

Why Does NFP Matter in Forex Trading?

The Forex market closely watches U.S. economic data, as it reflects the health of the world’s largest economy. Employment figures are especially important because they influence the Federal Reserve’s (Fed) monetary policy.

The Fed’s dual mandate aims for:

- Maximum Employment

- Stable Prices (Low Inflation)

A strong NFP report with solid job creation and low unemployment usually supports the U.S. Dollar (USD). Conversely, disappointing job numbers can weaken the USD.

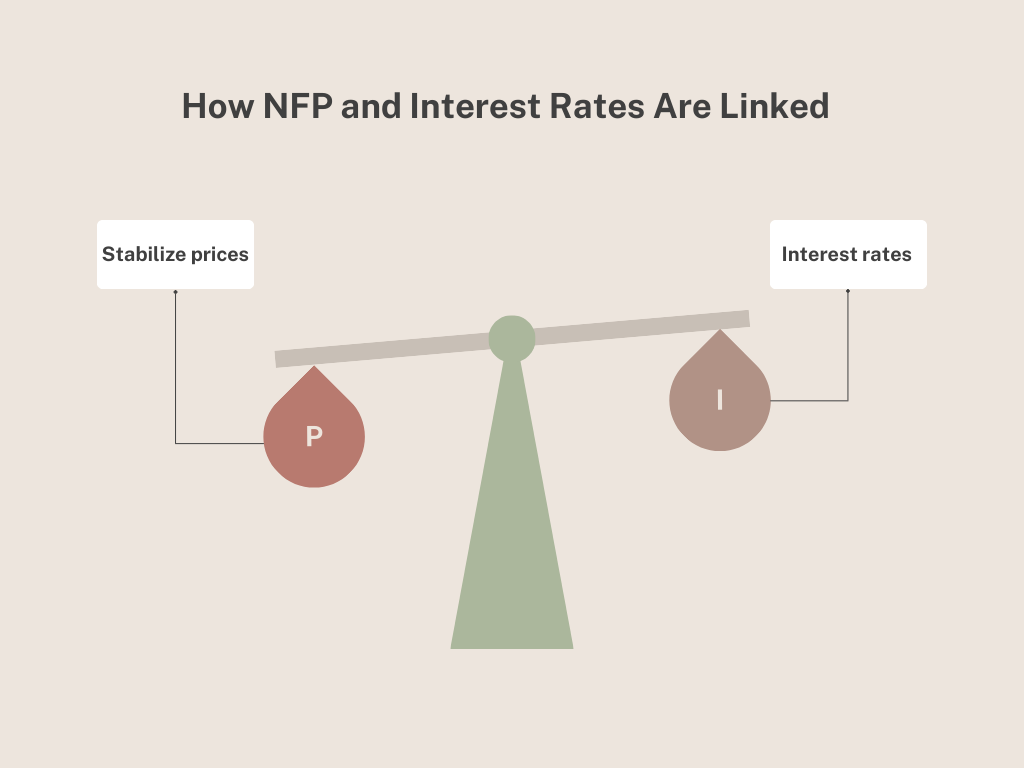

How NFP and Interest Rates Are Linked

NFP data also impacts inflation trends. After the pandemic, inflation surged globally due to supply chain disruptions and increased demand. To control inflation, central banks, including the Fed, raised interest rates to slow down spending and stabilize prices.

High interest rates made borrowing more expensive, cooling the economy. However, as inflation remained persistent, the Fed had to carefully balance between job creation and inflation control. A strong labor market often signals potential inflation, influencing the Fed’s decisions.

Recent Trends and the December NFP Report

In November, the U.S. added 227,000 jobs, keeping unemployment at 4.2%. This solid performance boosted the USD. For December, economists predict 160,000 new jobs, with unemployment steady at 4.2%.

The impact on the Forex market depends on how the actual data compares to expectations:

- Better-than-expected job growth: Likely to strengthen the USD.

- Worse-than-expected data: Could weaken the USD.

Big deviations from forecasts often lead to significant price movements in currency markets.

Key Takeaways for Forex Traders

- Watch the NFP report: It provides critical insights into U.S. economic health.

- Understand the Fed’s role: Their interest rate decisions hinge on employment and inflation trends.

- Stay alert: Large deviations in NFP data from expectations can cause major market volatility.

By keeping an eye on the NFP report, Forex traders can better anticipate market movements and make informed trading decisions.

To gain insight into how macroeconomic factors affect both the forex market and the crypto market, be sure to explore our blog on “how the Federal Reserve’s decisions are shaping the crypto market“. Discover more about trading automation and market trends with AlgoDeltaFX by reading more here

image source : mondo

source : fxstreet , globaltimes